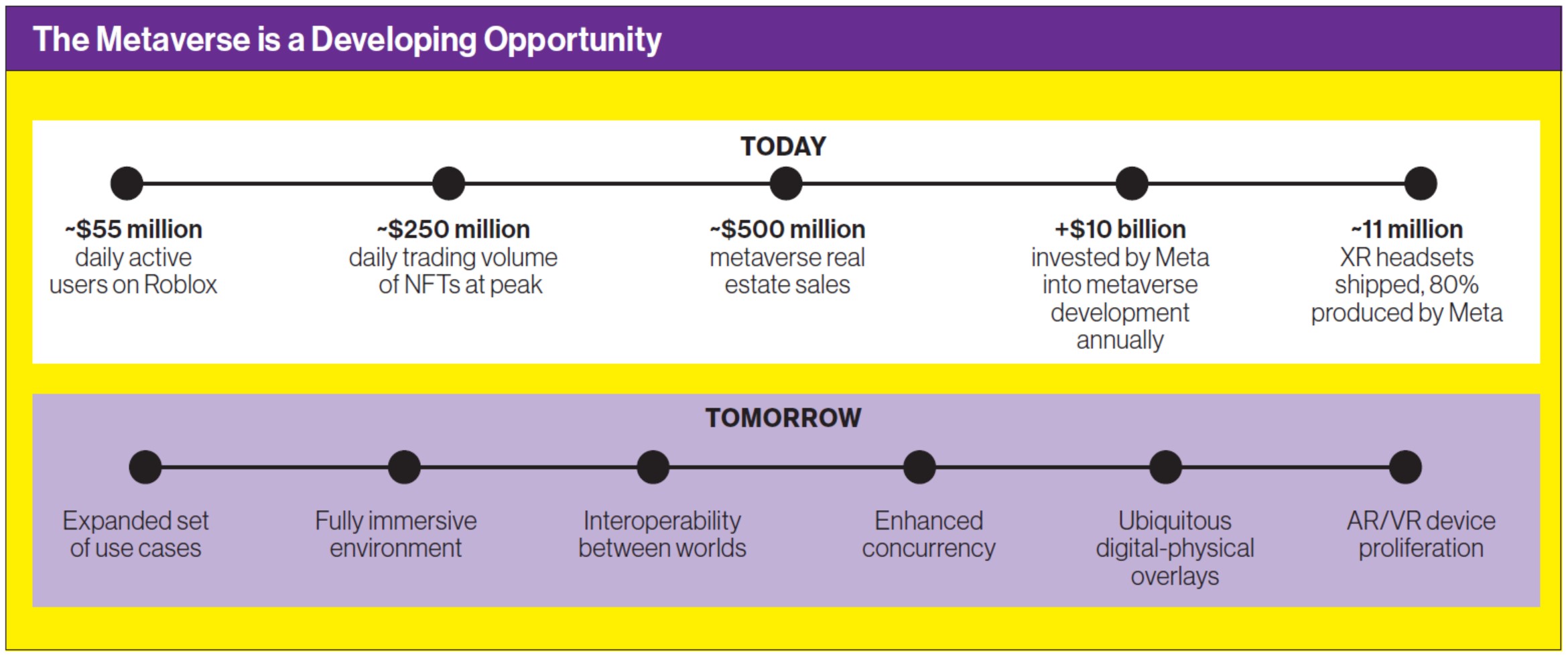

Interest in the Metaverse has exploded. Global Google searches for ‘metaverse’ skyrocketed 7,200 per cent last year, and metaverse online gaming platform Roblox reportedly hit over 55 million daily active users in February 2022. Meta committed more than US$10 billion to its Reality Labs division, which makes metaverse-related hardware such as VR goggles. And Microsoft said its planned $69 billion acquisition of gaming company Activision Blizzard would “provide building blocks for the metaverse.”

Total metaverse-related investment is also proving to be significantly larger than it was for AI, which attracted $39 billion in investment in 2016 — arguably a similar stage in its development trajectory to the metaverse today. While total VC and PE investment is somewhat comparable — AI was $6 billion to $9 billion in 2016; the metaverse is $6 billion to $8 billion so far this year — M&A activity is much bigger. We attribute this to the fact the metaverse has emerged, for the most part, as a pure digital play for many companies, exemplified by Microsoft’s intended purchase of Activision Blizzard for around $69 billion.

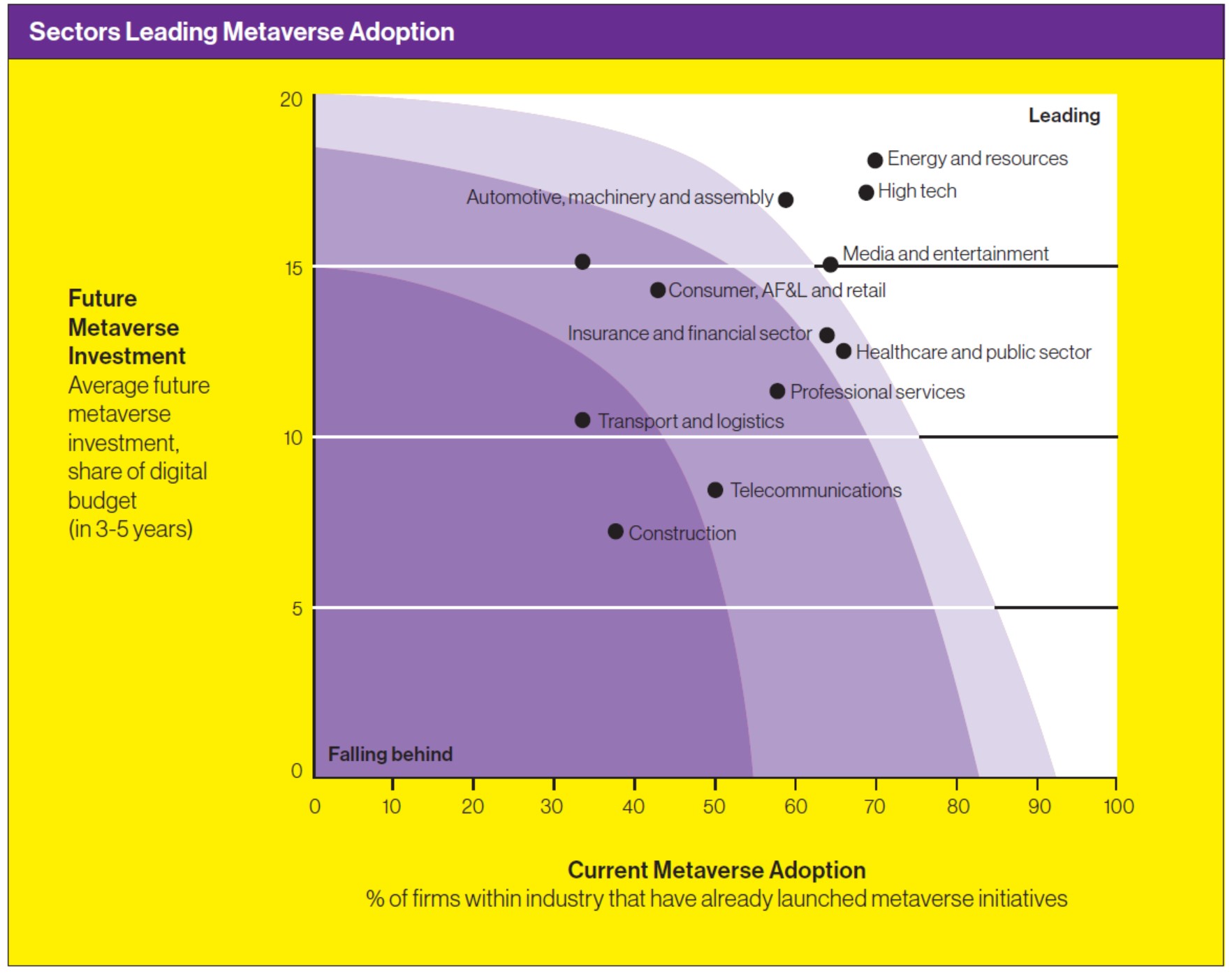

Meanwhile, the sectors leading metaverse adoption also plan to dedicate a significant share of their digital investment budgets to the metaverse, with energy (18 per cent); automotive, machinery and assembly (17 per cent); high tech (17 per cent); tourism (15 per cent); and media and entertainment (15 per cent) among those leading the charge in terms of allocating share of digital budget to metaverse-related activity over the next three to five years.

The broader investment landscape is dominated by three categories of investors:

LARGE TECHNOLOGY COMPANIES. Meta, Microsoft, Apple and Alphabet, among others, are taking deliberate actions toward shaping the metaverse. The most prominent example is Facebook’s name change to Meta, solidifying its intent to become a leader in the space, but others include Microsoft’s intended Activision Blizzard acquisition, NVIDIA Omniverse, the planned release late this year of Sony’s PlayStation VR2 headset, and the possibility of Apple entering the AR space in 2023.

The metaverse offers growth opportunities that first-mover

brands are keen to explore and develop.

VENTURE CAPITAL. VC is investing heavily in the space. Examples include non-fungible token (NFT) marketplace OpenSea raising $300 million at a $13.3 billion valuation in a Series-C funding round led by Paradigm and Coatue, metaverse technology company Improbable raising $150 million led by Andreessen Horowitz and SoftBank, Yuga Labs (creator of the Bored Ape Yacht Club) raising $450 million at a $4 billion valuation to build a virtual world, The Sandbox receiving $93 million from SoftBank,41 and Niantic receiving $300 million from Coatue.

CORPORATIONS AND BRANDS OUTSIDE OF TECH. Forward-thinking companies are putting resources behind efforts to get ahead. Disney appointed a senior executive to oversee its metaverse strategy, for instance, while LEGO invested in Epic Games (makers of Fortnite). Epic Games also collaborated with luxury brand Balenciaga, which has created a dedicated metaverse division and launched its latest collection inside a virtual space. The most recent technological trends and advancements such as e-commerce, smart devices and social media are arguably starting to reach a point of declining returns in terms of their ability to generate a competitive advantage. In response, brands are seeking innovative ways to get ahead of the competition. With its expanding number of use cases, the metaverse offers growth opportunities that first-mover brands are keen to explore and develop.

Of course, the distribution of investments across the metaverse ecosystem can be seen as either troubling or inspiring. It is troubling if you view the metaverse at this point — unlike previous consumer-led revolutions — as generating more excitement among technology companies and executives than from actual consumers. Yet it is inspiring if you view the involvement of brands as a sign that they have learned from previous consumer-led revolutions and want to be involved earlier this time around.

What does this mean collectively? It means that this idea that we’ve thought of for decades is now more tangible, even if in the virtual sense. Like the current version of the Internet, the metaverse is expected to show significant network and synergy effects, meaning the value of each individual metaverse feature (such as owning digital assets) will increase with the amount of use cases and consumer offerings. This means a fully integrated, end-to-end ecosystem must be built if the metaverse is to reach its full value proposition.

Factors Driving Investor Enthusiasm

While the long-term vision of the metaverse is still to be realized, the early version is well established. More than three billion gamers globally are fuelling it, and that proof of concept makes a difference for investors. In fact, there are multiple factors driving their enthusiasm and the growing belief we are at an inflection point where the metaverse, as many imagine it, will begin to materialize.

The infrastructure required to run the metaverse has rapidly improved and opened up new possibilities. While significant technology challenges remain, we have already seen blockchain spark the decentralized creator economy and emerge as the most promising current technology for achieving the promise of the future metaverse for interoperability between worlds. The full rollout of 5G (and beyond) will enable processing these large worlds on mobile devices. Following are some of the other advances that will facilitate the development of the metaverse.

BACK-END ENGINES WILL ERODE BARRIERS TO CREATION. The improved availability of the back-end engines that drive the user experience (in particular Unreal Engine and Unity) have reduced the barrier to creation as a wider audience of studios and creators have gained access to creating advanced games and experiences. This advancement is critical to the metaverse, as it enables the shift from more traditional 2D internet spaces to more immersive experiences.

EDGE COMPUTING WILL POWER THE METAVERSE. Edge computing, also known as multi-access edge computing or mobile edge computing, will play an important role in driving the computing power required to run the metaverse. At its core, edge computing enables data to be captured, stored and processed locally across smart devices and local networks rather than in the cloud. By obviating the need to send data to the cloud to be processed, edge computing helps solve problems of limited bandwidth and latency — critical for an immersive, high-fidelity experience.

5G WILL PLAY A DEFINING ROLE. 5G technology solves the need for faster networks with lower latency to enable vastly more connected devices to process data, including VR headsets or AI-powered bots that will open-up experiences such as the sense of touch, and AR that lets visitors have in-depth conversations with AI hosts. The full rollout of 5G is regarded as critical to facilitating edge computing, although there is already discussion about the potential of 6G to enable more sophisticated uses of the metaverse.

DEVICES WILL MERGE THE PHYSICAL AND VIRTUAL WORLDS. While AR/VR devices aren’t yet mainstream, they’re maturing fast. Meta shipped 10 million Oculus Quest 2 headsets in 2021, and new devices including gloves and bodysuits — some with haptic feedback — are gaining traction. With companies including Meta, Microsoft, Qualcomm and Sony leaning into the space, it is not unrealistic to expect a breakthrough in terms of adoption in the near future, as well as additional device types.

Software development will drive metaverse applications. Leading software companies are betting on the opportunity to build the ‘application layer’ on top of the infrastructure. For example, Microsoft is currently building and improving upon a number of metaverse enterprise solutions across the Microsoft cloud (such as Dynamics 365 Connected Spaces, Microsoft Mesh and Azure Digital Twins).

Increasing Stakeholder Readiness

Brands are already experimenting: luxury-goods company Gucci has a presence across many platforms, Nike has Nikeland in Roblox, and fast-food company Wendy’s has had an event in Fortnite and has a presence on Horizon Worlds. In addition, less-talked-about but sizable enterprise use cases also continue to scale, including specific categories such as retail, healthcare, and manufacturing, and also cross-sector examples such as learning and development, remote collaboration, conferences and events, and customer support.

We only expect more examples of consumer uses as the metaverse matures. “Use cases beyond gaming are not just in the future, they’re already emerging,” XR Safety Initiative founder and CEO Kavya Pearlman told us. “According to the United Nations, 1.6 billion children moved to online learning with the pandemic, so this is an area ripe for disruption where many people are looking for alternatives. We’re also seeing a lot of experimentation within the medical field, such as using HoloLens for assisted surgeries.”

The metaverse has the potential to impact sectors

that have long avoided digital disruption.

We envision the fully developed, long-term version of the metaverse to encompass most daily activities, spanning five core categories:

1. GAMING, which has been driving the development of the metaverse.

2. SOCIALIZING, which extends existing consumer behaviour through platforms such as Decentraland, The Sandbox and Second Life.

3. FITNESS, which often marries gaming and connectivity through providers such as Peloton.

4. COMMERCE, which includes Sotheby’s proprietary marketplace for curated NFT art, virtual-only fashion company Fabricant, as well as start-ups promoting an immersive retail experience, including Obsess and AnamXR. A primary question is whether the metaverse can be a channel for selling real products at scale, and emerging technology enabling thousands of people to simultaneously interact may help.

5. REMOTE LEARNING, which groups individuals in virtual classrooms.

The metaverse also has the potential to impact sectors angel investor Matthew Ball describes as “categories that have long avoided digital disruption.” He told us his hope is “that the metaverse and VR and AR will finally start to show actual, tangible, measurable productivity improvements in education and healthcare.”

Solutions for Organizations

The metaverse will enable incremental improvements in the enterprise solutions we know today alongside entirely new innovations. Notable categories include the following:

ENHANCED REMOTE COLLABORATION. An incremental improvement will see a move from 2D screens to an immersive 3D space as online meetings in the metaverse further enable remote work and potentially diminish the need for co-locating. As we move towards this transition, we expect to see a continuation of the pandemic-induced rethinking of how organizations are structured.

REIMAGINED LEARNING AND DEVELOPMENT. Simulations of real-life settings and situations will allow for a far more captivating learning process, opening possibilities both in onboarding new colleagues and developing current personnel, which is increasingly important for organizations competing for talent on a global scale.

DIGITAL TWINS. We are also seeing new innovations such as BMW’s effort to build a digital factory twin on NVIDIA Omniverse, which is expected to drive efficiency improvements across its supply chain. By building virtual replicas of physical settings and objects that generate data in real-time, far richer analyses can be generated than previously to enable improved decision making.

Business agendas and larger tech investments will likely focus on those that move the productivity needle, such as automation and process visualization. Today, 50 per cent of our work activities can be improved with these technologies, which include robotics, digital twins, and 3D or 4D printing. There is also a rapid expansion of use cases in the public sector. For instance, Dubai’s Virtual Assets Regulatory Authority earlier this year established Metaverse HQ on The Sandbox, making it the first regulator in the emerging digital space. The Dubai Metaverse Strategy estimates the metaverse will add $4 billion to its economy and support 42,000 jobs by 2030.

The first city government is also set to join the metaverse: leaders in Seoul, South Korea, announced a five-year Metaverse Seoul Basic Plan that will begin by creating a virtual City Hall, plaza and civil-service centre. The CIO of Seoul’s Smart City Policy Bureau, Jong-Soo Park, told us the objective is to provide civic freedom, participation, engagement and communication. “We believe that with the metaverse we can create higher-quality government services,” he said. “Current government services are demand-driven. However, we believe that in the future we can provide services in advance of demand.”

There are also emerging examples of using the metaverse to address social issues, such as the Whole Earth Foundation’s Guardians of Metal and Concrete game, which crowdsources data collection to capture infrastructure conditions in real time so repairs can be made. “I’m quite interested in the aspect of blockchain as an incentive scheme,” Square Enix’s Yosuke Matsuda said, referring to the game. “It’s trying to solve social issues with games using the incentive scheme of blockchain. This is opening up whole new possibilities.”

A New Kind of Internet

Consumers are increasingly expressing discontent with many aspects of the Internet as it has evolved today, from the proliferation of misinformation to social-media platforms’ effects on users’ mental health. In parallel, creators are increasingly expressing discontent with the way in which content is monetized and proceeds distributed.

This is contributing to the ‘Web3 movement’ gaining momentum globally, with the potential result being a major disruption in value pools. That is investors are staking a position early. We believe the intense interest of the past year ignited dramatic corporate experimentation which has laid a foundation for the metaverse’s evolution and will likely maintain momentum for the foreseeable future.

We have eagerly adopted technology for decades, both personally and professionally. In the past two years alone, many have rapidly and largely seamlessly adjusted to carrying out more daily activities virtually both on the job (videoconferencing) and in private (socializing, dating), while the pandemic also swiftly accelerated the adoption of e-commerce, and we relied more than ever on technology to live our lives. Our research finds consumers and executives are excited about what is next, with many already using and experimenting with the metaverse and eager to realize its potential.

Almost 60 per cent of consumers we surveyed are excited about the transition of everyday activities to the metaverse, with connectivity being the number one driver of excitement. What kind of connectivity are we talking about? When we asked consumers what they hoped to be doing in the metaverse within the next five years, for many the answer was socializing and communicating with family and friends. Yet connectivity also encompassed a broad range of activities offering commercial growth opportunities, such as entertainment (66 per cent responded they were ‘excited’ or ‘very excited’ about attending live events such as concerts and sports, as well as seeing movies and attending festivals and museums), gaming (66 per cent) and shopping (64 per cent).

The metaverse should not be a substitute for the real world

or the in-person connections that bind us.

Travel is another activity respondents were excited about (62 per cent). The main themes in metaverse-specific travel related to the possibility of going beyond the limits of the physical world, including time travel; fantastical, exotic places that are difficult to access; and space travel. The survey also identified strong demand for travel to hospitals and care homes, further underlining the desire for connectivity.

In addition, the wide adoption of virtual tools has legitimized gaming and virtual socialization, with early metaverse platforms such as Roblox, Minecraft and Fortnite experiencing accelerated popularity. The conventional core audience for gaming continues to solidify the central role of gaming in today’s entertainment landscape: 81 per cent of Gen Z have played video games in the past six months, averaging 7.3 hours per week.

“You’re at the point where everyone engages in digital experiences in some way, shape or form,” Activision Blizzard’s Ken Wee said. “COVID-19 accelerated it, but I view it as a trend that’s only grown over the years. You look at our King mobile-gaming business, the audience skews female and is far less likely to self-identify as a video gamer in the traditional sense of the word.” That demographic expansion is reflected in the top five activities respondents most prefer in an immersive world compared with traditional alternatives.

Omnichannel commerce is now second nature to most consumers, with payment credentials often embedded in the devices and software they use. ‘Social commerce’ — integrating commerce with social-media entertainment — is already estimated to comprise almost 15 per cent of total retail in China, and is rapidly growing globally as well. For the three billion gamers in the world today, the virtual goods economy is estimated to comprise nearly 75 per cent of global gaming revenues.

That’s one reason we believe consumer spending on digital assets in the metaverse will only grow. Another reason? Excitement about the metaverse increases with income: 53 per cent of those who identified as ‘higher income’ were very excited compared with 32 per cent of respondents with medium incomes and 25 per cent of lower income earners.

In closing

By 2030, it is entirely plausible that more than 50 per cent of live events could be held in the metaverse; more than 80 per cent of commerce could be impacted by something consumers do there; and most learning and development could happen in a metaverse environment, as could most virtual or hybrid collaboration. Asset-heavy enterprises such as manufacturers and telecommunications companies may have virtually all assets and processes represented in a ‘digital mirror,’ and the same applies to the simulation of physical products and spaces to aid their design. We expect the average Internet user to spend up to six hours a day in metaverse experiences by 2030.

Stakeholders have an opportunity to shape the metaverse in a way that fosters greater social cohesion, reduces inequality, widens access to education and acts as a catalyst for social mobility. The metaverse should not be a substitute for the real world or the in-person connections that bind us. It should complement what people do and, like virtual and in-person offices, allow free movement between the virtual and physical worlds in a way that expands our range of experiences rather than limiting them. Achieving this vision will require collective leadership to ensure the actions taken responsibly shape the evolution of this revolution.

Tarek Elmasry is a Senior Partner and Global Co-Leader of McKinsey & Co.’s, Technology, Media & Telecommunications Practice. Eric Hazan is Senior Partner and Co-Leader of the firm’s Paris office and a member of the McKinsey Global Institute Council. Hamza Khan is a Partner in the London office and UK and Ireland co-leader of the Growth, Marketing & Sales (GM&S) Practice. Greg Kelly is a Senior Partner in the Atlanta office and Global Leader of the GM&S Practice. Shivam Srivastava is a Partner in the Bay Area practice. Lareina Yee is a Senior Partner in the Bay Area Practice. Rodney W. Zemmel is a Senior Partner in the New York Office and the Global Leader of McKinsey Digital. Their complete report, “Value Creation in the Metaverse,” is available online.

Share this article: