How to measure the financial impact of climate change. How to gauge public sentiment in order to shape new government policies. These are tough challenges — but the answers can be found in the data, Rotman students say.

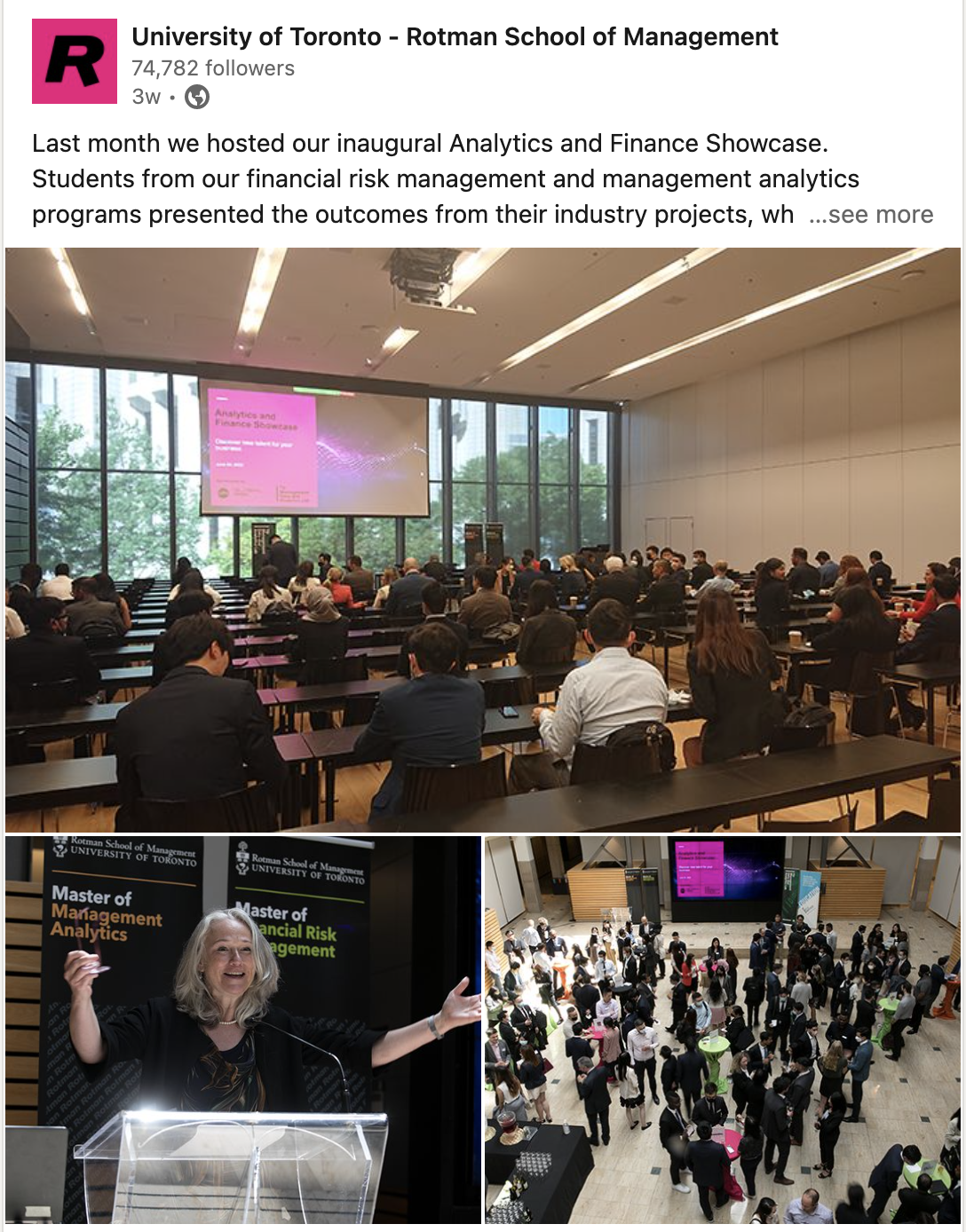

Every year, students in the Master of Management Analytics (MMA) and Master of Financial Risk Management (MFRM) programs partner with companies to develop data-driven solutions for real challenges facing the organizations. In June 2022, graduating students from both programs came together to present their practicum projects to an audience of industry professionals, peers and faculty members at Rotman’s first Analytics and Finance Showcase.

“Finance and analytics are core to much of what we do at Rotman, and these practicum experiences are invaluable in providing real-world applications we want to bring to our MMA and MFRM students,” said Rotman Dean Susan Christoffersen at the event.

This year, more than 45 industry partners, including KPMG, Unity Health Toronto, the Hudson’s Bay Company and TD Bank took Rotman students under their wings.

For Tarun Anand (MFRM ’22), who has a background in applied math and mechanical engineering, a highlight of the program was working in a startup environment on a machine learning project. With a goal to transition into a role in finance and risk management, Anand says he enjoyed applying tools like Python and financial modeling to real-world scenarios — experience that would set him up for success in future jobs.

Tarun Anand, MFRM ’22

Anand and his teammate, Beren Ilgaz Unsal (MFRM ’22), partnered with Wave Financial, a company that offers accounting, payroll and invoicing solutions for micro and small businesses. They worked closely with Wave’s manager of strategic projects and risk, Danylo Kostecki.

The challenge? Many of Wave’s customers — who work as consultants, artists, photographers and beyond — often have a few large transactions each year with long lag times before the funds arrive in their bank accounts. Wave wants to advance a new product for their clients called Instant Payouts: a faster process to turn recognized transactions into cash which merchants can access to keep their businesses afloat.

“We approached the project like a consultant would,” says Anand, who begins a new role as an enterprise risk management consultant at KPMG’s Toronto office this fall. “They had an idea to target a specific customer group and allow the product to be accessible by the greatest number of customers. Yet we discovered that such a plan would be too risky due to its scale.”

Anand and Unsal analyzed customer data and identified the key risks for Wave when undertaking a short-term loan product. In the end, they designed a risk-tiering algorithm for short-term loan products that informs Wave’s product strategy.

“The first thing they told us is that they’ll be taking our recommendations seriously,” said Anand. “It was great experience to build and deliver an analysis that would be used in the business.”

For Sally Wen, Kinley Rigzin, Johnny Li and Maokuan Zhou (MMA ’22), their practicum project led to full-time roles with their partner company, Veeva Systems.

Sally Wen, Kinley Rigzin, Johnny Li and Maokuan Zhou, MMA '22

Veeva provides cloud-based software solutions for regulated industries such as consumer goods and healthcare. For their practicum project, the group worked with Veeva to automate the report-making process that pharmaceutical representatives use when working with healthcare professionals around the world. The Rotman team used Python to create a complex algorithm that tracks changes in prescribing behaviours of oncologists and hematologists as they switch hospital networks.

“The team’s recommendations and methodologies were insightful and interesting, and we’re using some of the tables they generated in our day-to-day work,” says Elnaz Alipour, a data science team lead at Veeva who worked closely with the Rotman students.

“They’re well-rounded data professionals with good communication skills and technical abilities. The fact that they’re now familiar with our data and the pharmaceutical and healthcare industries is a highly appreciated bonus."

Wen, who studied financial analysis and risk management during her undergraduate studies, is pivoting into an associate commercial analyst role at Veeva’s New York office. Coming into the MMA program, she wanted to broaden her career beyond the financial industry, while still applying skills from her degree to her career.

“During the program, most of our projects are in randomly assigned teams. That forces you to step outside your comfort zone and solve problems with different people,” Wen says. “You don’t get to choose your teammates in real life and learning how to work with different people is key — and I learned how to do that at Rotman.”

After their showcase presentation, a vice-president at a large insurance company approached the team to talk about their approach.

“I’ve seen a lot of demand for soft skills, especially strong communication,” says Rigzin, who joins Veeva full-time as an associate data scientist. “The program really provides you with a great mix of technical and soft skills. That’s what stood out to me from other programs that just focus on data science or business analytics.”

For Zhou, the practicum project was key in preparing him for a career in data science.

“It allowed us to apply the tools we learn in class to a real workplace, working closely with their data scientists and learning from their experience,” he says.

The Rotman Finance and Analytics Showcase was hosted with support from the TD Management Data and Analytics Lab and TD Bank Group.

Written by Jessie Park | More Student Stories »