By Sandria Officer, PhD, Research Officer @JohnstonCentre

The unstoppable pace of new technologies has compelled companies from around the world to adopt a measured approach to the management of their digital tools and leadership. When the COVID-19 pandemic hit, attention to technology took on new meaning in part from e-commerce and remote work. Some companies adapted their old processes to new technologies to expand their business pursuits, while others, determined to remain at the forefront of the technological changes, automated their processes to increase efficiency and decrease costs.

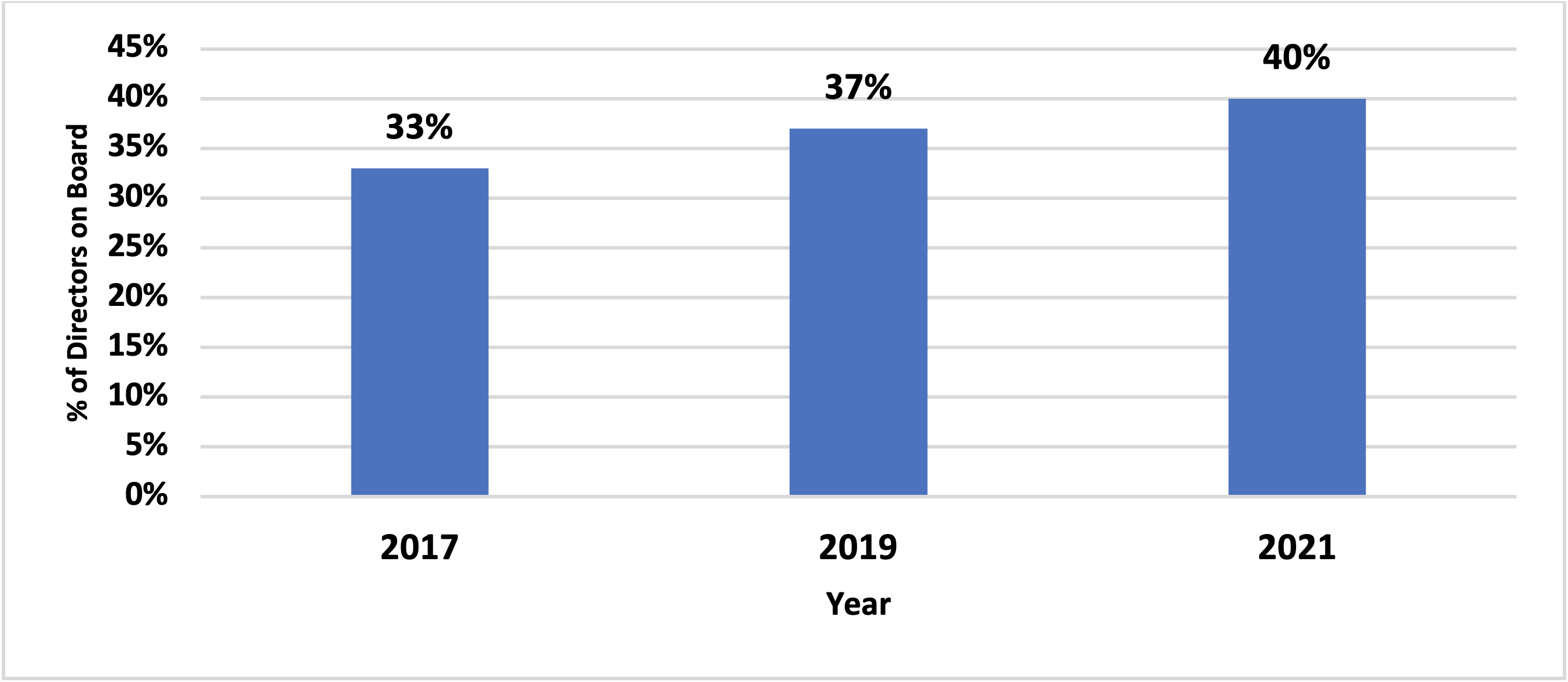

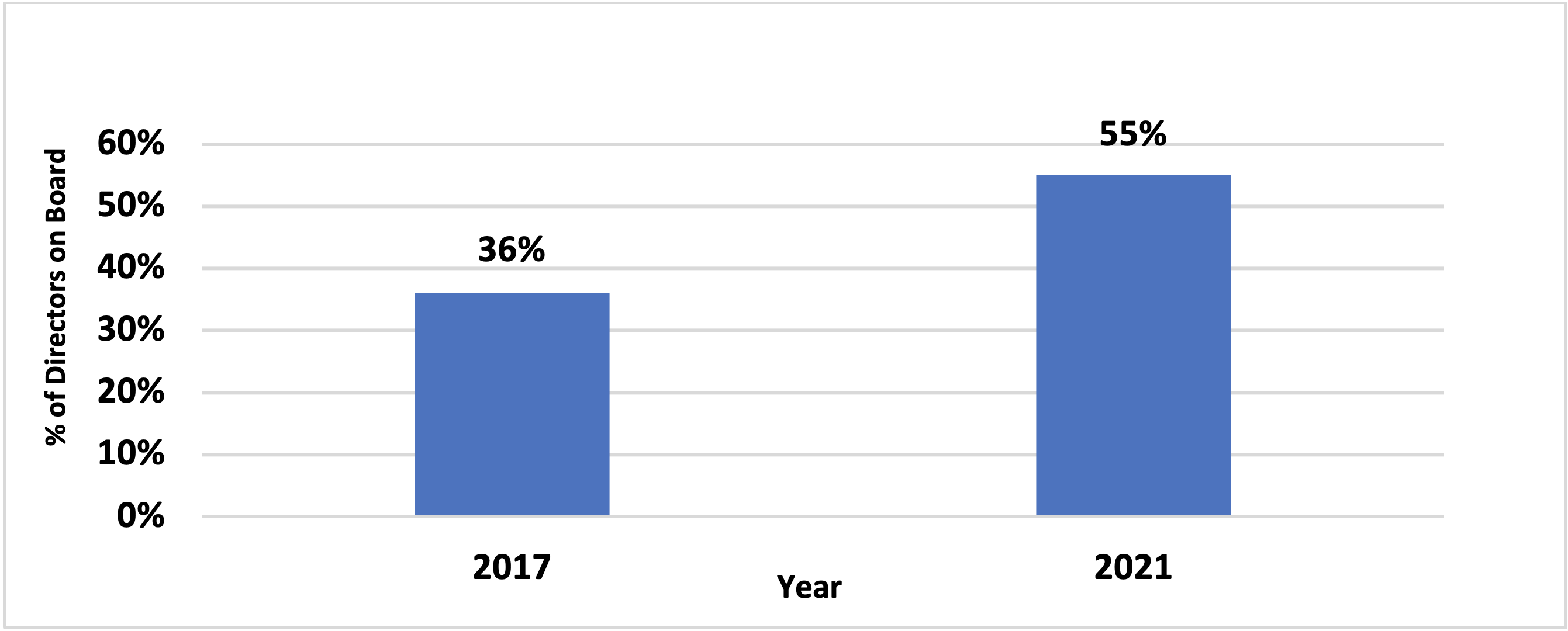

Now an ever-increasing number of companies are using technology roadmaps to define goals and satisfy market demands and trends. This digital revolution, at the corporate board level means that every board will need to be skilled in technology to remain competitive in the global marketplace. But preliminary findings from research conducted by the David and Sharon Johnston Centre for Corporate Governance Innovation found a large proportion of directors on boards lacked technological skills. As Figures 1 and 2 shows, the median proportion of directors with technological skills in Canada in 2021 was at 40 per cent and in the United States at 55 per cent. These numbers were up from 33 per cent and 36 per cent respectively, in 2017.

Figure 1

2017 – 2021 TSX Index: Median Proportion of “Tech Savvy” Directors on Boards with “Tech Savvy” Directors

Figure 2

2017 – 2021 S&P 500: Median Proportion of “Tech Savvy” Directors on Boards with “Tech Savvy” Directors

The report’s preliminary findings show that board composition in Canada and the U.S. must evolve more quickly to ensure that the right team of directors with the appropriate expertise is chosen for the long-term survival of a company. Companies that lack directors with technological expertise are in danger of costly mistakes when they develop their new technological strategies and systems.

What is the board of directors’ changing role in companies?

The growing movement in corporate governance is towards getting more corporate directors with specialized skillsets, particularly in technology, and decreasing the board appointments of former chief executive officers and chief financial officers. Digital tools have automated some of senior management’s tasks by enabling them to share accurate information from anywhere in real time using more efficient decision-making business processes. Tasks that may have taken days or weeks can now occur in minutes through automation, which may result in a shift in the distribution of powers and a reshuffling of corporate roles and functions. For example, lower-level management jobs and employees may vanish and be replaced by automated processes, and duties assigned to executive officers may also become automated because prior higher-level operating tasks have automated and become easier to manage.

Corporate boards of directors are an elected group of individuals who are responsible for:

- overseeing a corporations’ guiding principles and policies;

- approving or sending back for amendment management recommendations about the future direction of a corporation, and;

- selecting top management.

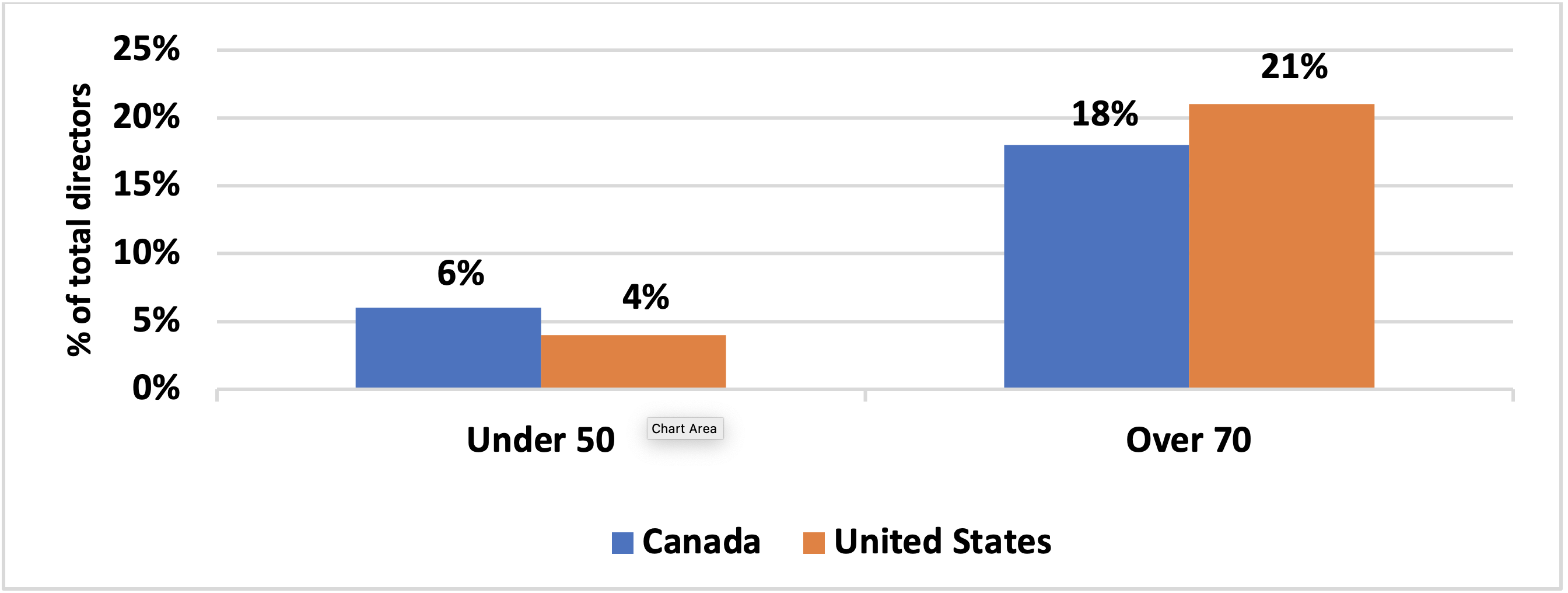

When corporations fail it is due in large part from a poorly performing corporate board. Figure 3 data from the David and Sharon Johnston Centre for Corporate Governance Innovation preliminary report indicates the median total of directors on boards under the age of 50 in Canada in 2021 was just 6 per cent while over the age of 70 it tripled to 18 per cent. The numbers in the U.S. were 4 per cent and 21 per cent respectively, in 2021.

Figure 3

Proportion of Total Directors on Boards: 1) Under Age 50, and; 2) Age 70 and Older in Canada and the United States (2021).

These findings show the need for an increase in the age diversity of directors on corporate boards. By expanding the pool of talent, boards will obtain more opportunities to select candidates with the skills that they need. For instance, there is an increase in the number of first-time board directors, and this is a direct result of their hands-on experience in digital transformation and their technological expertise.

The responsibilities of board directors are still rooted in traditional skillsets such as leadership, financial, industry, and CEO experience. But directors should also now have digital acumen – if they do not have it - to grasp how each new technological tool is tied and compounded by each other and may restructure existing corporate roles and functions. This insight empowers directors to identify and oversee the management of potential problems and opportunities that arise from new technologies. Some companies realize, however, that their boards might need skill refreshment, which means a new director may need to be included on a board or a director may need to be replaced for one with skills that are distinct from the rest of the board.

Board of directors' technological skills most sought after by companies

1. Data security

Cybersecurity is a corporate governance strategy to manage security incidents and risks. Companies need secure communication channels to share data and prevent unauthorized access. Cyber experts on boards oversee the management of the internal infrastructure and make product decisions. They protect information to avoid data leaks that would result in a public’s loss of confidence.

2. Management of big data, algorithms, and artificial intelligence

Artificial intelligence (AI) supports companies with its ability to analyze large data sets, find correlations in the datasets through algorithms, and identify profitable business strategies and solutions. Board directors with AI expertise monitor, organize, and oversee the management of the internal processes of companies. For example, AI is often used to keep track of inventory, customers’ orders, organize workers’ schedules, provide workers with instructions on how to fulfill tasks, and hire and lay-off workers.

3. Blockchain and smart contracts

Blockchains are distributed ledgers that computer programs use to execute transactions called smart contracts. Smart contracts automate agreements so that all participants are instantly informed of the outcomes without need for a middleman or time loss. Blockchain technical experts on boards oversee the applications such as share transfers, settling trades, voting procedures, and cryptocurrency. Companies with blockchain experts have more control and follow-up mechanisms around administrative tasks.

While companies need directors with specialized technological skills on their boards to remain viable in the marketplace, they also recognize that if those directors cannot effectively communicate with others, those technical skills will be discounted. Research shows that employees who are adept at combining their social and technical skills are the fastest to succeed in the modern economy. For the past 40 years nearly all job growth has been in professions that are relatively social-skill-intensive because they are hard to automate. Consequently, companies require directors with both technical and social skills to ensure that their strategic business objectives are fulfilled.

Social intelligence is the ability to communicate and develop relationships based on empathy and assertiveness. It stems from the capacity to understand and manage one’s own emotions and fit into a variety of social contexts. Board directors with social intelligence are in demand because of their ability to clearly communicate, foster effective teamwork, and develop productive work environments.

How can we get more directors with technological skills onto corporate boards?

Continuing education and upskilling

Upskilling refers to the process of individuals learning new skills through continuous education provided through learning opportunities that broaden competencies and lessen skill gaps. To stay current with changing technologies and the evolving issues that may affect company success and strategy, even very experienced directors on boards will need to lead by example and continually update their knowledge and skills through continuing education and upskilling.

Consider term limits

Boards with term limits can create entry points for new experience and make it easier to diversify the board and introduce new ideas, expertise, and perspectives. Term limits help boards change their members to reflect the companies’ evolving needs. They also confront issues such as age-based stereotyping, which intersect with other forms of categorization, whether they are positive or negative, connected to, for example - competence, adaptability, and intelligence.

Establish technology committees

Technology committees are formed in companies to identify and handle the potential risks and challenges of new technological tools. Independent directors or technical specialists are recruited to bridge the knowledge and communication gaps between the executive management and the board of directors. The committee is crucial for ensuring that current and future business plans effectively unfold without concern over cyber threats, investment feasibility, or regulatory problems.

The volatile nature of technology has transformed how corporations do business. To remain viable in a competitive global economy, boards of directors must improve their technological knowledge and skills to understand and strategically respond to market demands.

The David and Sharon Johnston Centre for Corporate Governance Innovation: Rotman School of Management. (Release fall 2022). Director Ages and Technology Skills Analysis,” 5-6.