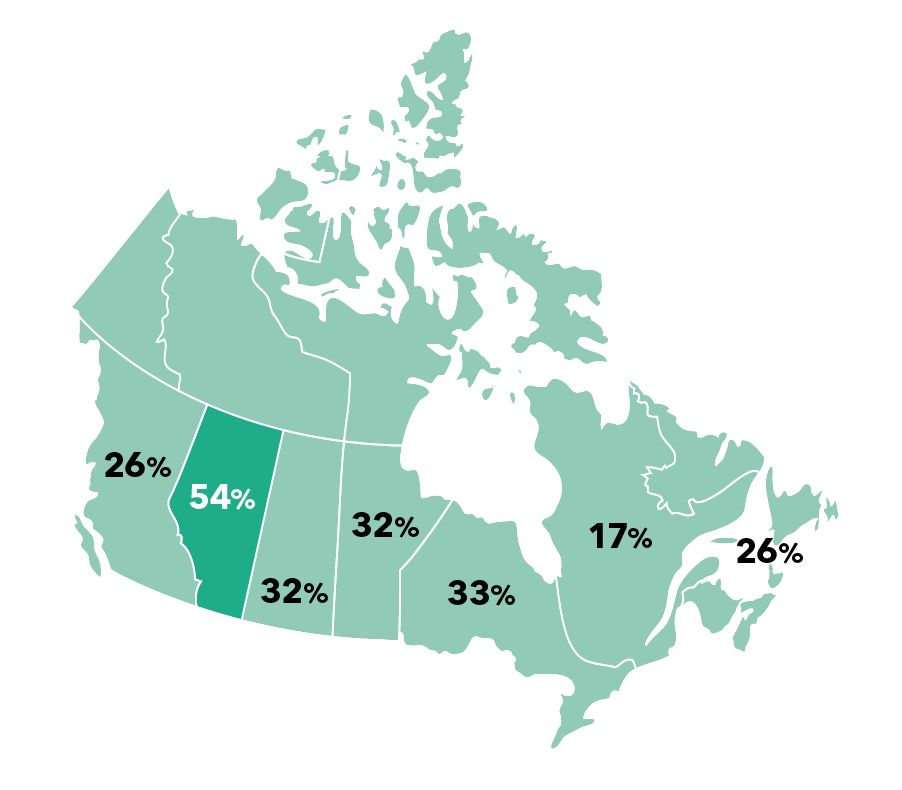

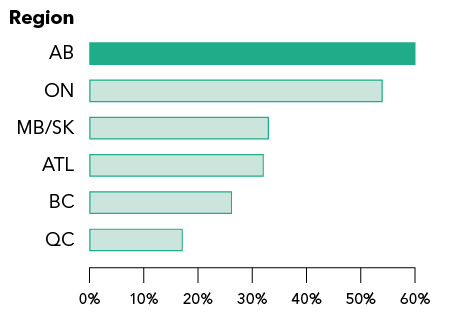

Alberta’s directors are uniquely concerned about Canada’s future.

Looking ahead over the next 10 years, Alberta directors tend to have a much more pessimistic view on prosperity in Canada.

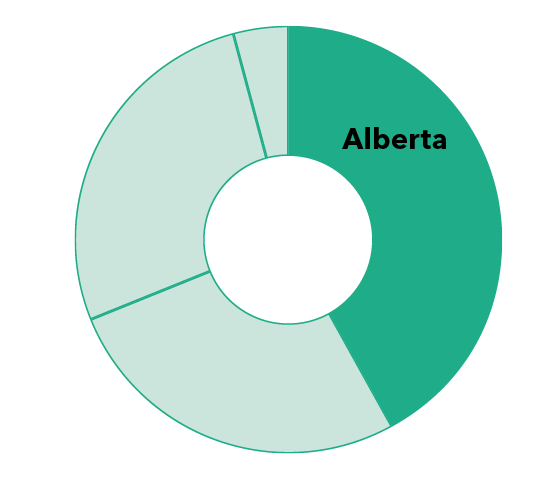

% Answered “Less Prosperous”

Figure 1 – Question 7

ICD Director Lens Survey Fall 2018 Question 7 — Looking ahead over the next 10 years do you expect that Canadian society will be... Answer: Less Prosperous

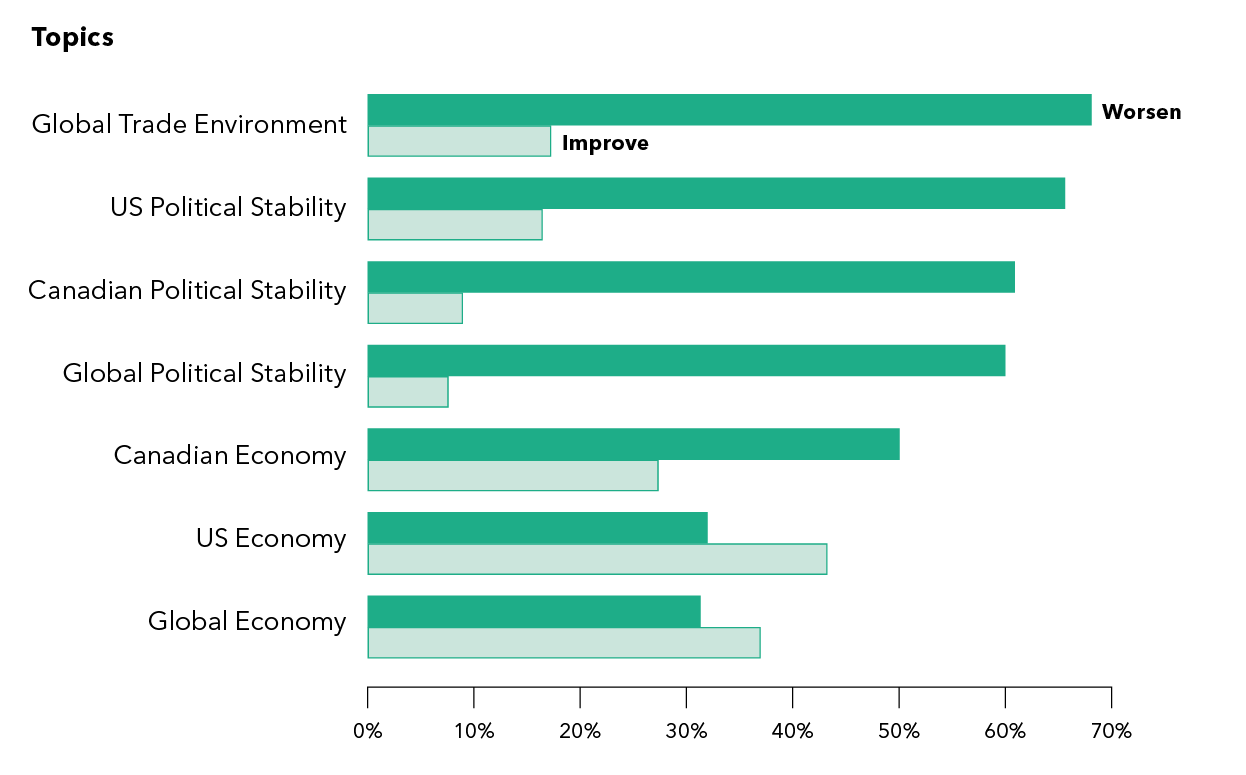

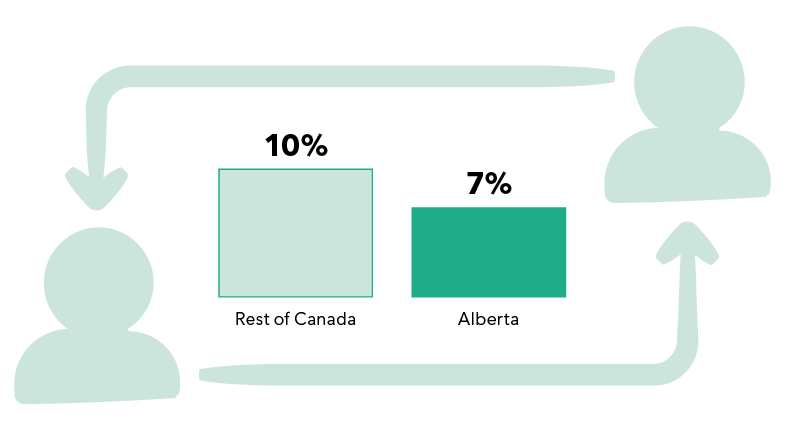

Many of Alberta’s directors believe the Canadian political environment will limit prosperity and stability, at least in in the short-term. Making matters potentially worse, directors across Canada believe that the current political uncertainty between the US and Canada has negatively impacted the long-term economic relationship between

the two countries.

Many Alberta directors indicated that most matters will worsen instead of improve over the next 2–5 years.

% of participants.

Source: ICD Director Lens Survey Fall 2018

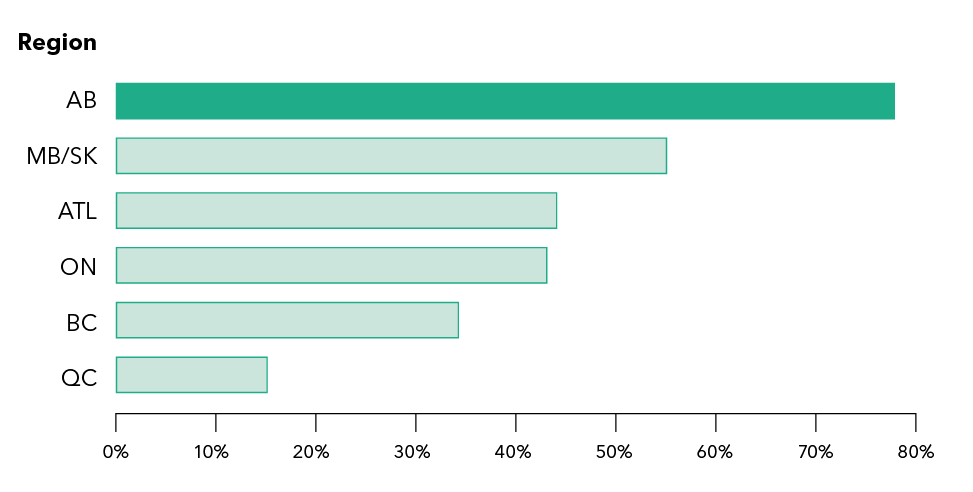

Given these sentiments, it’s not at all surprising that Alberta’s directors, more than any other province, feel that Canada is headed in the wrong direction overall.

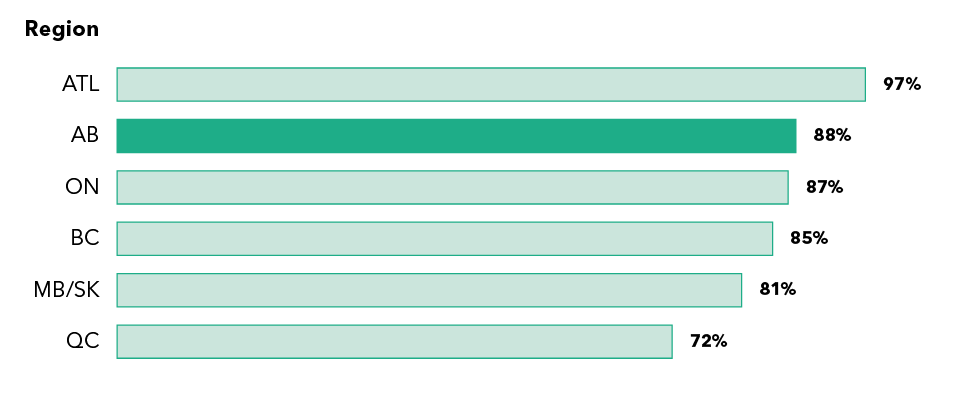

Canadian directors think the long-term economic relationship between Canada and the United States will be negatively affected by the current political uncertainty.

% who believe there is a negative effect.

Source: ICD Director Lens Survey Fall 2018

Directors from Alberta tend to feel that Canada is on the “wrong track.”

% who believe Canada is on the “wrong track”

Figure 2 – Survey Question 6a

"Overall, would you say that Canada is currently heading..." Participants could answer from "Strongly on the right track" to "Strongly on the wrong track" on a 4-point Likert-type scale.

Source: ICD Director Lens Survey Fall 2018

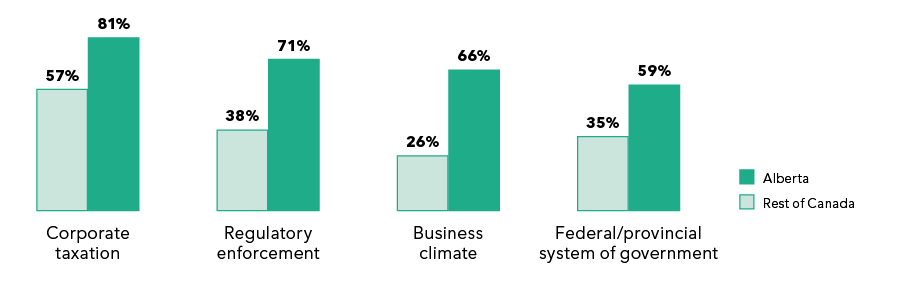

Directors highlighted three particular areas of concern that they believe require change to provide the opportunity for Canada to become more globally competitive.

- Corporate taxes are too high or stifling growth.

- The federal/provincial government policies are not providing a platform for prosperity and growth and

- The regulatory enforcement is strict, making rapid adjustments difficult.

Compared to the rest of Canada, most directors from Alberta believe that Canadian society will be less prosperous in 10 years.

% who believe Canada will be less prosperous.

Source: ICD Director Lens Survey Fall 2018

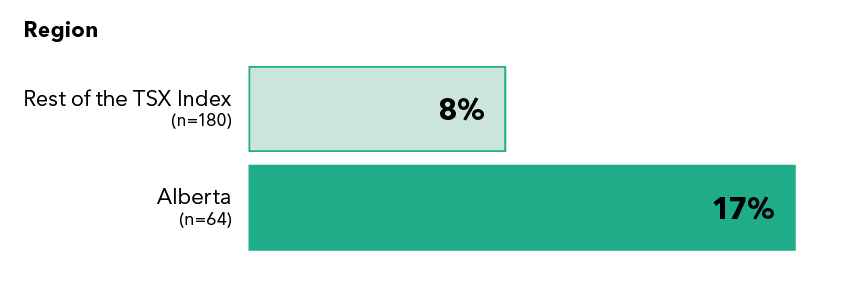

Compared to the rest of Canada, directors from Alberta have lower confidence in Canada’s competitiveness.

% answered “uncompetitiveness” Survey choices on matters of global competition

Source: ICD Director Lens Survey Fall 2018

Managing director concerns

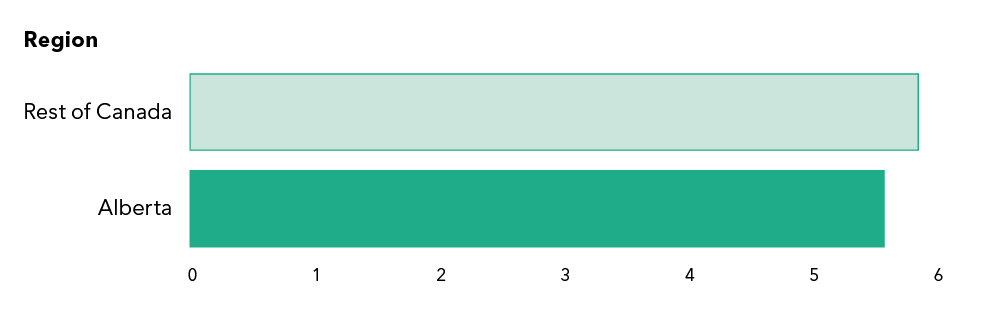

Board and CEO tenure

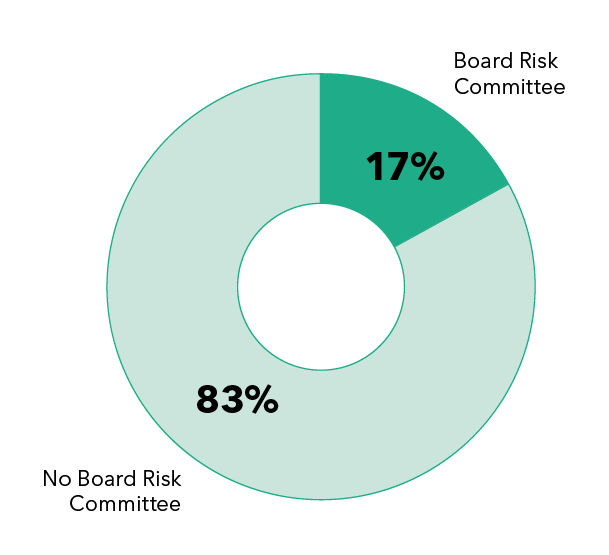

Some boards have specialized risk committees with mandates to focus on risk management beyond the corporation’s finances. These committees, while still relatively rare, became more common after the 2008 Financial Crisis.

On the TSX Index, 40 of the 233 Canadian companies have board level risk committees. Of those companies, ten are from Alberta. The popularity of board risk committees is especially low considering that many US cross-listed Financials sector TSX Index companies are required to have a risk committee under the Dodd-Frank Act.² However, the vast majority of Canadian companies with board risk committees have no special legal requirement to form one and have done so voluntarily.

Board Risk Committees are not common among TSX Index listed companies in 2018

Source: David & Sharon Johnston Centre for Corporate Governance Innovation

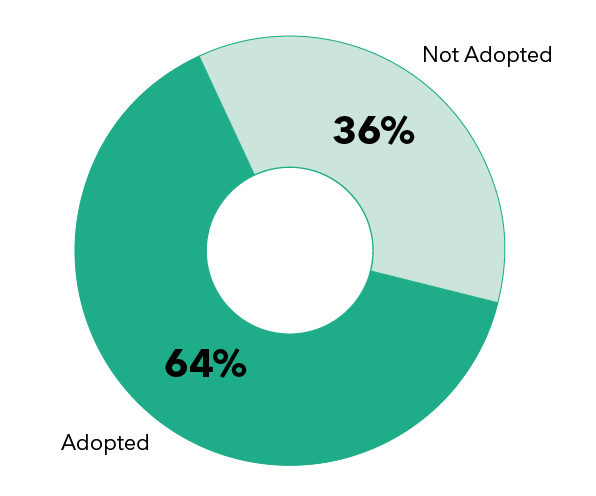

While TSX Index companies don’t typically form standing board risk committees, some companies use specialized committees to direct focus to important matters. For example, almost two-thirds of the Energy Sector companies located in Alberta have a board committee focusing on environmental, health and safety (EHS) issues that focus on the risk management, policy development and regulation of EHS matters. Will we see the emergence of additional specialized risk committees to help Alberta’s boards manage the significant risks presented by the current political and economic climate?

The percentage of TSX Index Alberta Energy Sector Companies with a board Environmental, Health and Safety Committee in 2018.

Managing director concerns

Gender diversity

There is an ever-increasing body of evidence that suggests groups with diverse skills and demographics make better decisions. Diverse boards are more likely to consider more factors when making decisions and in fact, can help reduce the risk of bankruptcy.1 Regardless of the pace of board turnover in Alberta, they have an opportunity to address important risks by prioritizing diversity. Currently, Alberta’s largest companies are lagging behind the rest of Canada in this regard. For example, of the 26 Canadian companies on the TSX Index without a female board member, 11 are from Alberta.

On the TSX Index, almost half of the companies without women on the board are in Alberta.

Source: David & Sharon Johnston Centre for Corporate Governance Innovation

TSX Index companies in Alberta are much more likely to have no women on the board compared to the rest of Canada.

Source: David & Sharon Johnston Centre for Corporate Governance Innovation

Companies in Alberta lag behind the rest of the TSX Index in board gender diversity.

Source: David & Sharon Johnston Centre for Corporate Governance Innovation

Managing director concerns

Board structure changes

Some boards have specialized risk committees with mandates to focus on risk management beyond the corporation’s finances. These committees, while still relatively rare, became more common after the 2008 Financial Crisis.

On the TSX Index, 40 of the 233 Canadian companies have board level risk committees. Of those companies, ten are from Alberta. The popularity of board risk committees is especially low considering that many US cross-listed Financials sector TSX Index companies are required to have a risk committee under the Dodd-Frank Act.² However, the vast majority of Canadian companies with board risk committees have no special legal requirement to form one and have done so voluntarily.

Board Risk Committees are not common among TSX Index listed companies in 2018

Source: David & Sharon Johnston Centre for Corporate Governance Innovation

While TSX Index companies don’t typically form standing board risk committees, some companies use specialized committees to direct focus to important matters. For example, almost two-thirds of the Energy Sector companies located in Alberta have a board committee focusing on environmental, health and safety (EHS) issues that focus on the risk management, policy development and regulation of EHS matters. Will we see the emergence of additional specialized risk committees to help Alberta’s boards manage the significant risks presented by the current political and economic climate?

The percentage of TSX Index Alberta Energy Sector Companies with a board Environmental, Health and Safety Committee in 2018.

Emerging risks and challenges in 2019

Corporate boards face ever-increasing internal and external pressure to provide meaningful oversight of emerging risks related to corporate culture, environmental sustainability and Artificial Intelligence (AI) technology. 3, 4 Each of these areas is made even more challenging by the fact that they present unique risks and opportunities for every company. As boards become more savvy, they will be better able to challenge and support management on emerging risks and opportunities including the deployment of artificial intelligence or risks associated with other emerging technologies. Does your board understand AI applications in your company and also across

the industry?

Alberta's unique strength

Technology entrepreneurship

There was positive momentum in 2018 towards a more diverse Alberta economy. This is important because many of the over 100,000 jobs that were lost in the last few years are perhaps gone for good.5 Oil patch companies are operating with fewer employees by deploying better technology and encouraging innovation.6 According to the 2018 Alberta Technology Deal Flow Study, Alberta has seen a high rate of technology startups since 2016. In fact, approximately one-third of Alberta’s tech companies were established in that short time. Furthermore, the study found that women either founded or co-founded 30% of the tech companies in Alberta, compared to 13% for the rest of Canada.7 These are both extremely positive signs during what may seem like desperate economic times. If Alberta’s economy continues to diversify and grow, so will the opportunity to begin filling the void left by the jobs lost in the energy sector.

Conclusion

In ICD’s Fall 2018 Director Lens Survey, Alberta’s directors took the opportunity to clearly express their concerns about their companies, their economy and the country. Despite what may seem like discouraging results, measuring these challenges provides us with an opportunity to address them. The composition and structure of Alberta’s public company boards provide some guidance about opportunities to evolve through diversity and specialized risk oversight, which may improve the long-term prospects of Alberta’s issues. Meanwhile, Alberta’s thriving startup culture has perhaps been overshadowed during the recession, but provides clear reasons for long-term optimism for the province and for Canada as a whole.

For our next report, we will gather insights from entrepreneurs in Alberta about the role that good governance can play in the success of startups.

Appendix

ICD Director Lens Survey Fall 2018 Participant Breakdown

The Fall 2018 Director Lens Survey measures the perspectives and intentions of Canada’s directors on global and Canadian economic and political stability, boards’ oversight of technology, workplace harassment, human capital issues and shareholder engagement.8 The ICD conducted the survey from September 15th to October 19th 2018 and it yielded responses from 600 board members. Of which, 157 were from Alberta board members.

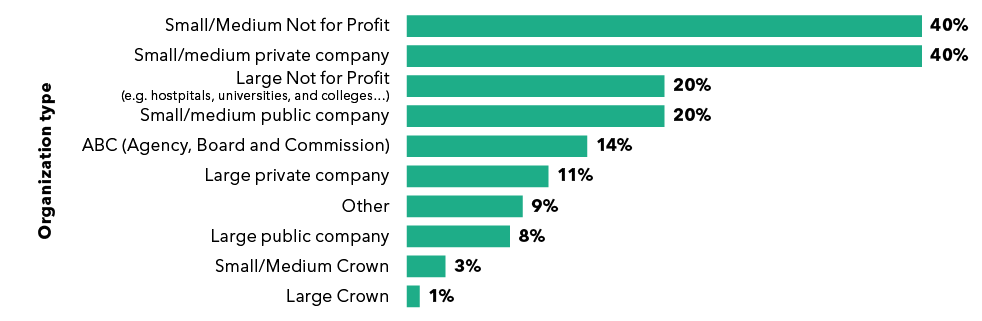

Breakdown of Alberta director memberships by organization type.

Directors can select more than one board type.

% of Participants

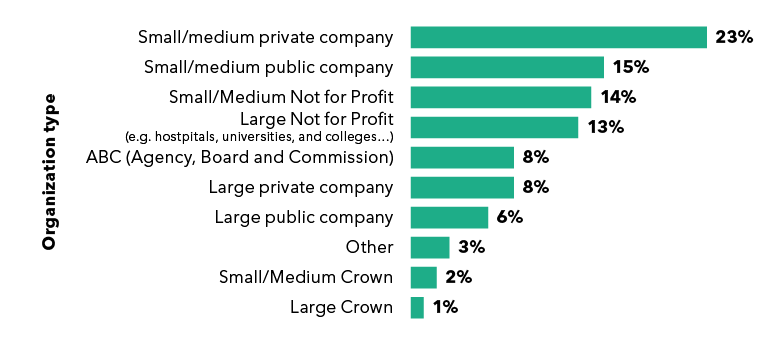

Breakdown of board chosen by Alberta directors as their primary board.

% of Participants

S&P/TSX Composite Index 2018 Constituent Breakdown:

The Johnston Centre used the management information circulars to collect the company and director information of the S&P/TSX Composite Index (TSX Index) companies in 2018. The 239 companies included in the data were on the TSX Index as of September 2018. The board member data is correct as of the date of the company’s 2018 annual general meeting.

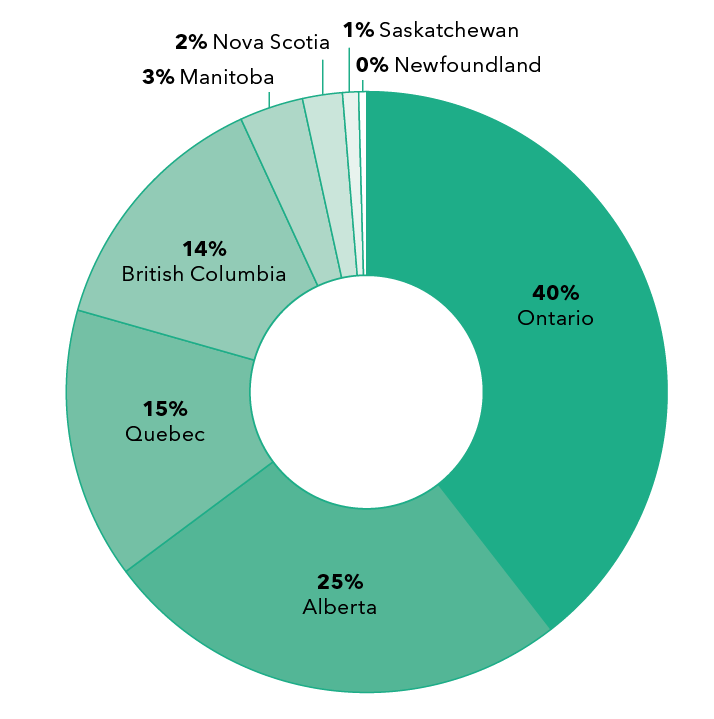

2018 S&P/TSX Composite Index breakdown by Province

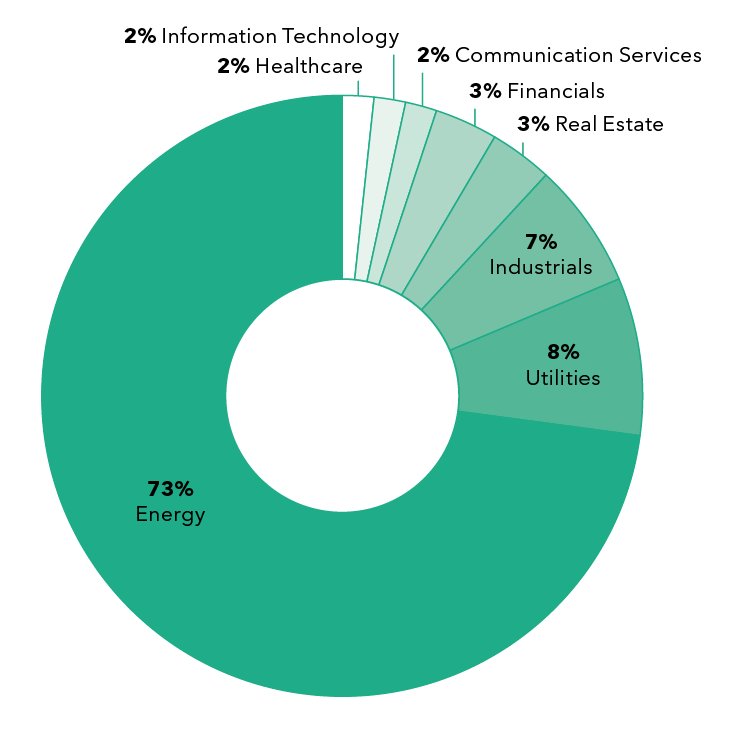

Alberta 2018 S&P/TSX Composite Index sector breakdown.

References

1Almandoz, J., & Tilcsik, A. (2016). When Experts Become Liabilities: Domain Experts on Boards and Organizational Failure. Academy of Management Journal, 59(4), 1124–1149. doi:10.5465/amj.2013.1211

² Dodd-Frank Act Section 165(h).

³ O'Kelley, R., Goodman, A., Martin, M., & Russell Reynolds Associates. (n.d.). 2019 Global & Regional Trends in Corporate Governance. Retrieved from https://corpgov.law.harvard.edu/2018/12/30/2019-global-regional-trends-in-corporate-governance/

4 When boards look to AI, what should they see? #BoardMatters. (n.d.). Retrieved from https://www.ey.com/gl/en/issues/governance-and-reporting/center-for-board-matters/ey-when-boards-look-to-ai-what-should-they-see

5 Cattaneo, C. (2017, September 08). 100,000 jobless energy workers struggle for a place in the new economy. Retrieved from https://business.financialpost.com/commodities/energy/100000-jobless-energy-workers-struggle-for-a-place-in-the-new-economy

6 Snowdon, W. (2018, March 07). Thousands of energy jobs lost to Alberta downturn are gone for good, economist says | CBC News. Retrieved from https://www.cbc.ca/news/canada/edmonton/atb-todd-hirsch-alberta-energy-jobs-recession-rebound-1.4566269

7 Saba, R. (2019, March 03). A third of Alberta tech companies have a female head - twice the Canadian average. Retrieved from https://www.thestar.com/calgary/2019/03/03/a-third-of-alberta-tech-companies-have-a-female-head-twice-the-canadian-average.html

8 Institute of Corporate Directors. (2018). Director LENS Survey Fall 2018. Retrieved from https://www.icd.ca/getmedia/a1b73c10-a1b9-4065-a671-87e9ec6ae13e/17-2366-Directors_Lens_Survey_Fall_2018_EN_final.pdf.aspx